Broker: Trading Platform

Introduction to Broker

Exness, established in 2008, operates as a multi-asset broker headquartered in Limassol, Cyprus. The company offers trading services for forex, stocks, indices, commodities, and cryptocurrencies. Exness has gained popularity among traders due to its competitive spreads, diverse account types, and advanced trading platforms. The broker caters to both novice and experienced traders, providing a range of tools and features to enhance the trading experience. Exness holds multiple regulatory licenses, ensuring a secure trading environment for its clients.

Trading Instruments and Markets

Exness provides access to a wide array of trading instruments across various markets. Traders can engage in forex trading with over 100 currency pairs, including major, minor, and exotic options. The platform offers CFD trading on global stocks, allowing investors to speculate on price movements without owning the underlying assets. Additionally, Exness supports trading in commodities such as gold, silver, and oil, as well as major stock indices from around the world. Cryptocurrency enthusiasts can trade popular digital assets like Bitcoin, Ethereum, and Litecoin.

- Forex: 107 currency pairs

- Stocks: 93 global companies

- Indices: 10 major indices

- Commodities: 18 options including metals and energies

- Cryptocurrencies: 10 digital assets

Account Types and Features

Exness offers several account types to cater to different trading styles and preferences. The Standard Account provides commission-free trading with variable spreads, suitable for beginners and intermediate traders. For more experienced traders, the Raw Spread and Zero accounts offer tighter spreads with a commission structure. Professional traders can benefit from the Pro account, which combines competitive spreads with no commission. Exness also provides Islamic accounts for traders adhering to Sharia law.

Standard Account Features

The Standard Account at Exness offers a user-friendly trading experience with the following features:

- No minimum deposit requirement

- Variable spreads starting from 0.3 pips

- Commission-free trading

- Maximum leverage of 1:2000 (subject to regulatory restrictions)

- Access to all available trading instruments

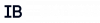

Trading Platforms and Tools

Exness provides traders with access to industry-standard platforms as well as proprietary solutions. The MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms are available for desktop, web, and mobile devices, offering advanced charting tools, technical indicators, and automated trading capabilities. Exness has also developed its own web-based platform called Exness Terminal, which features a user-friendly interface and integrates with TradingView charts.

Exness Terminal Features

The Exness Terminal platform offers several advantages for traders:

- Real-time price quotes and market depth

- One-click trading functionality

- Customizable watchlists and layouts

- Integration with TradingView charts (100+ technical indicators)

- Access to Trading Central analysis and signals

Platform | Devices | Features |

MT4 | Desktop, Web, Mobile | Advanced charting, EAs, Custom indicators |

MT5 | Desktop, Web, Mobile | Multi-asset trading, Market depth, Economic calendar |

Exness Terminal | Web | User-friendly interface, TradingView charts, One-click trading |

Spreads and Commissions

Exness offers competitive pricing structures across its account types. The Standard Account features variable spreads without additional commissions. Raw Spread and Zero accounts provide tighter spreads with a commission per lot traded. The exact spread and commission values may vary depending on market conditions and the specific instrument being traded.

Standard Account Spreads

Average spreads for popular instruments on the Standard Account:

- EUR/USD: 0.7 pips

- GBP/USD: 1.2 pips

- Gold: 25 cents per ounce

- US30 index: 2.5 points

Deposits and Withdrawals

Exness supports a variety of payment methods for deposits and withdrawals, catering to the needs of traders. The broker does not charge fees for deposits or withdrawals, although third-party payment providers may apply their own fees. Processing times for transactions are generally fast, with many methods offering instant deposits and quick withdrawals.

| Payment Method | Deposit Time | Withdrawal Time | Fees |

| Bank Cards | Instant | Up to 24 hours | No fees from Exness |

| Bank Transfer | 1-5 business days | 1-5 business days | No fees from Exness |

| E-wallets (Skrill, Neteller) | Instant | Up to 24 hours | No fees from Exness |

Customer Support and Education

Exness provides 24/7 customer support through multiple channels, including live chat, email, and phone. The support team assists traders in various languages, including Arabic and English. Exness also offers educational resources to help traders improve their skills and knowledge. These resources include video tutorials, trading guides, and webinars covering various topics related to financial markets and trading strategies.

Regulation and Security

Exness operates under multiple regulatory licenses to ensure compliance with international standards. The broker is regulated by the Cyprus Securities and Exchange Commission (CySEC) for its European operations. For clients in global markets, Exness is authorized by the Financial Services Authority (FSA) of Seychelles. The broker implements strong security measures to protect client funds and personal information, including segregated accounts and encryption technologies.

Security Measures

Exness employs several security features to safeguard client accounts:

- Two-factor authentication (2FA) for account logins

- SSL encryption for data transmission

- Regular security audits and penetration testing

- Negative balance protection for retail clients

Regulatory Body | Jurisdiction | License Number |

CySEC | Europe | 178/12 |

FSA | Global | SD025 |

FCA | United Kingdom | 730729 |

Social Trading and Copy Trading

Exness offers social trading features through its Social Trading platform, allowing traders to follow and copy the strategies of successful traders. This feature benefits both experienced traders who can share their strategies and earn additional income, as well as novice traders who can learn from more seasoned market participants. The platform provides detailed statistics and performance metrics to help users make informed decisions when selecting traders to follow.

Frequently Asked Questions:

The minimum deposit varies depending on the account type and payment method. For Standard and Cent accounts, there is no minimum deposit requirement, while Professional accounts typically require a minimum deposit of $200.

Yes, Exness provides free demo accounts for both the Exness Terminal and MetaTrader platforms. These accounts allow traders to practice strategies and familiarize themselves with the trading environment using virtual funds.

Exness offers leverage up to 1:2000 for clients trading through its FSA-regulated entity. However, the actual leverage available may vary depending on the instrument being traded and the trader’s account equity.